Colibri Financial Services Agents

So, you’ve been tasked with generating savings for your company, maybe you want a report of your financial services arrangements to educate new staff, or perhaps you just want to test the market to provide peace of mind or to keep your provider honest.

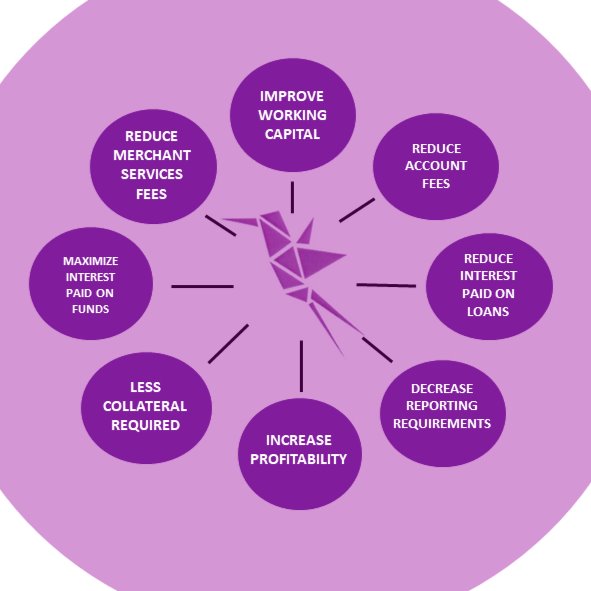

Our team of independent, unbiased, and experienced financial services professionals can quickly review, report, identify savings and even negotiate on your behalf to maximize your financial benefits.

Time is money...we can help you save both.

"Do what you do best, then outsource the rest," Peter Drucker, Management Consultant

Commercial Enterprises

You're too busy!

Financial and accounting staff are overworked and overwhelmed by changes on a regular basis…but what if there was a better way? Can you get benefits without the effort? Of course, outsource the process, not the decision!

Businesses with greater than $3Million in annual revenue who are looking for an immediate payback period or exponential ROI, can outsource the review and renegotiation of financial services arrangements.

Unlike other consultants or accountants, our service is delivered by independent, unbiased financial services professionals with extensive experience in dealing with Atlantic Canada’s largest companies. Because of our confidence in our ability to deliver solid results, our fee is based on the amount of hard dollar savings generated.

You’d hire a professional to help with your accounting and your taxes. You’d hire a professional for legal matters or for a real estate transaction. You’d hire a professional for an executive search. Why not hire a professional to assist with your financial services arrangements?

Whether it’s lower account fees, improved rates on Merchant Services processing, reduced loan rates, or improved yields on deposits, we have the experience and market knowledge to help you achieve your cost reduction targets and unlock funding for other purposes.

Additional Solutions

Based on our extensive commercial financial services experience, we also provide assistance and guidance on:

- audits of financial services and merchant services arrangements for SME's

- assistance with selecting the best bank, accounts and services for your start-up

- detailed reviews and comparisons of project financing proposals

- international banking requirements

- cash management, payment and electronic banking strategies

- liquidity management strategies

- trade finance matters

- foreign exchange strategies

- strategic export plans

RECENT SUCCESS

*These results are provided for promotional purposes only; individual client results and methods will vary.

Colibri was engaged by a energy distribution company in Atlantic Canada, requesting a full banking analysis. While they had impressive pricing on their existing banking arrangements, multiple areas were uncovered for improvement in banking and operational costs. The comprehensive review produced annual savings in excess of $265,000 primarily in the areas of receivable collection and payables management.

Executive management was pleased with a three (3) year ROI in excess of 600%.

Colibri was selected by a prestigious academic institution to review multiple areas of their banking & investment services. Monthly improvements in investment income over $50,000 were achieved using a custom-built, live monitoring tool and collaboration with senior treasury officers.

A three (3) year ROI in excess of 600% was achieved due to the services provided by Colibri

About Colibri FSA

How many times have you thought you should be able to get a better deal for your business banking? Maybe you started the process but got weighed down with the administration required or moved on to other priorities. Maybe you want to change banks but don't want the hassle.

Why not outsource this profitable exercise to experienced bankers?

At Colibri FSA, we only have one agenda...to get your company the best banking deal possible!

Colibri FSA acts on your behalf, reviews all aspects of your business banking services, determines areas where there are potential savings, negotiates on your behalf to ensure you have the best arrangements available in the local marketplace, and presents the analysis for your final approval.

You outsource the process, not the decision.

The need for Colibri FSA was identified from interactions with hundreds of commercial banking clients. Many were requesting better deals or looking to change financial service providers for various reasons but did not have the internal resources - time, knowledge, expertise - to make the decisions and interactions necessary.

Our primary objective is to educate commercial clients of all sizes, enabling improved financial service decisions and empowering them to enhance their arrangements with banks and merchant services providers. For maximum impact, we can be engaged to negotiate on the client’s behalf.

We believe that by leveraging our expertise and placing us on your side of the negotiating table, you will be financially further ahead.

Meet Our Team

John

President and Co-founder

A graduate of St. Francis Xavier University, John has extensive small business, commercial and corporate banking services experience - regionally, nationally and internationally. During a 35 year career with a major Canadian bank, John was consistently awarded top performer status while providing superior levels of customer service. He has earned trusted advisor status with many of Atlantic Canada's largest and well-known companies. With a passion for doing things differently, finding the little things that make a big difference and doing what was right for the customer, John's banking career progressed from small town Newfoundland and Labrador to London, UK. where he was responsible for establishing a global transaction banking division for Western Europe. John has held the Certified Treasury Professional designation as well as completed the Canadian Securities Course.

Alex

Vice-President and Co-founder

A graduate from Mount Allison University, Alex has 5 years of banking experience in roles from customer service to commercial lending administration to cash management analysis - regionally and internationally. Passionate about finding efficiencies, leveraging technology to its fullest extent, and making sure the I's are dotted and the T's crossed, while always questioning why it's done that way, Alex is responsible for the operational aspects of the business.

'Dollars & Sense'

Ch, ch, ch, ch, changes

Sounds much better when David Bowie sings… anyway, the last 2 weeks saw GoT die an undignified death, the Big Bang Theory go out with a bang, and the Toronto Raptors make the NBA…

May 28, 2019

Is there a problem?

Growing up in Newfoundland and Labrador, we were taught to first try to fix something yourself. If you failed, it wasn’t a big deal, there was always someone else you knew, a…

May 15, 2019

Close the Window on Cheque Fraud

With 734 million cheques processed in Canada in 2018, exposure to potential cheque fraud remains extremely high. I used to joke with my clients and say that the only way to…

May 6, 2019

1 out of 5 ain't bad? Seriously?

In setting up for our own small business banking requirements, we recently visited the 5 major banks in our community to determine their account fees, assess customer service…

March 27, 2019

Keep on Dancin'

Keep on Dancin’ Many years ago, in the final year of my BBA at St. F.X. I had the distinct privilege of being instructed by…

January 24, 2019

Contact Us

To start the process of saving time and money on banking and merchant services,

email us

info@colibri-fsa.com

text or call

902-483-2342